How can you make an investment portfolio inflation-resistant?

Geert Van Herck

Chief Strategist KEYPRIVATE

June 08, 2022

(updated August 30, 2022)

4 minutes to read

Western industrialised countries are experiencing a real surge in inflation. After a long period of mainly stable inflation, prices of goods and services are now clearly going up.

For savers, this high inflation is an issue: traditional savings accounts are currently a loss-making investment. They receive almost no interest and their purchasing power is falling substantially. So how can Belgian savers protect the capital they have built up?

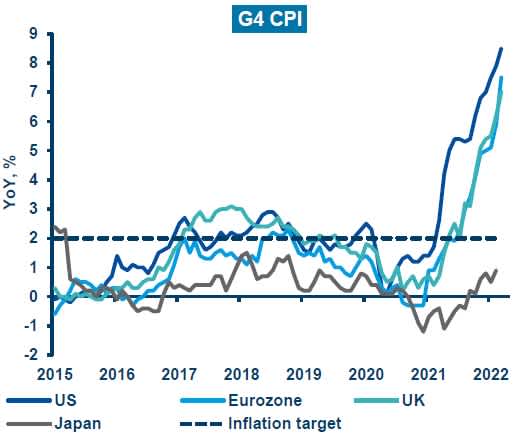

Diagram 1 leaves nothing to the imagination. Since 2021, all major economic regions have seen a sharp rise in inflation. Inflation in the US and the euro zone is above 7%. These are figures we have not seen for many years.

What is more, the inflation figures in the euro zone are well above the European Central Bank (ECB) target. The ECB aims for an average inflation rate of 2%. We can expect tighter monetary policy in the euro zone in the coming months (= an increase in official short-term interest rates in the euro zone).

Diagram 1: inflation in Western industrialised countries

Source: Amundi

But before delving into the causes of the current surge in inflation, we would like to explain why inflation is enemy number one for Belgian savers in particular. .

We refer to inflation when products and services are becoming more expensive. Inflation of 2% on average is considered to be good for the economy. It means that people do not postpone purchases because they expect lower prices in the near future. Unfortunately, inflation also means that your purchasing power is eroded if the interest on your savings is lower than inflation.

In other words, if your savings remain the same and inflation is 2% per year, after 1 year you can buy 2% less goods and services with the same money.

At present, inflation of 8.3% means a negative yield in real terms for Belgian savers, of around 8% (0.11% savings rate – 8.3% inflation in April 2022). Your purchasing power therefore falls by 8%.

Where is this surge in inflation coming from?

The answer is simple enough: the commodity market.

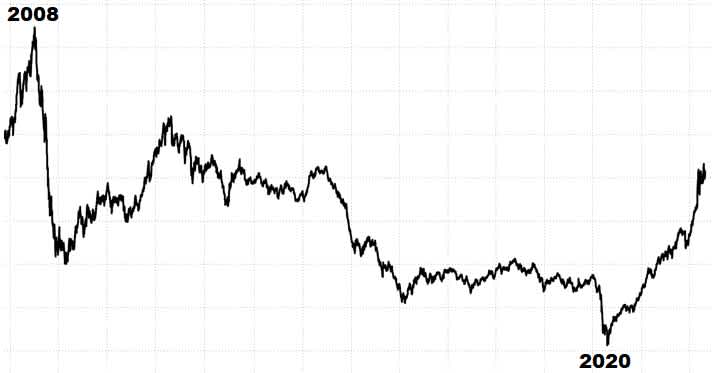

Following the sharp fall in commodity prices from 2008 to mid-2020, the trend reversed sharply in mid-2020.

The strong economic recovery following the first lockdown has revived the commodity markets. Prices for oil, natural gas, copper, aluminium and wheat shot up. Companies that had to accept and pay these higher commodity prices passed (all or part of) them on to their customers. Which meant we saw an increase in the overall level of prices.

Diagram 2: CRB commodity index

Source: Bloomberg

Shortages

An additional reason (and specific to the current macro-economic environment) that explains the current price increase is the shortage of specific electronic goods. Western companies can't run their production processes without them. p>

These are mainly the semiconductors that are built into computers and vehicles. The main production centres for semiconductors are located in the Far East (including Taiwan), and due to a very stringent coronavirus policy, these factories have been out of action for a long time. Meanwhile Western consumers have continued to buy computers, TVs and other electronics. The result was an imbalance between supply and demand, which created upward pressure on prices (see diagram 3).

Diagram 3: Global shortage of semiconductors

Source: S&P Global

How can you protect your savings against this high inflation?

This is still the most important question for any saver. Here are a few possible solutions for a diversified portfolio:

- Within the bond component, investors can opt for a greater weighting in inflation-linked bonds (see also our article dated 2 December 2021: “Scared by inflation? Have you ever looked at the mining sector?"). On our platform, we offer a number of trackers of the inflation-linked bond market.

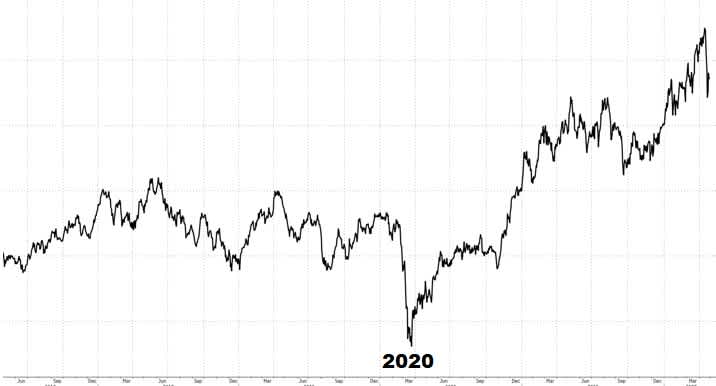

- Within the equity component, it might be time to increase your weighting in commodity shares. Diagram 4 shows the performance of the STOXX Europe 600 Basic Resources index: a sector-based index comprising the major European commodity companies. Rio Tinto, ArcelorMittal and Anglo American are some of the major shares in this sector. The large oil companies are also benefiting from higher oil prices and have already been performing well for the past two years. Corrections in these sectors could be an opportunity for investors. Once again, we have actively managed funds and trackers on our platform that invest in these sectors.

- Finally, part of your investment portfolio (10% – 15%) could also be invested in commodities. For example, in our Keyprivate discretionary asset management, we use a tracker of the prices of industrial metals. In addition, there are trackers available today that shadow the major commodity indices.

Diagram 4: STOXX Europe 600 Basic Resources index

Source: Bloomberg

Conclusion

Western industrialised countries are experiencing a real surge in inflation. Higher commodity prices and a scarcity of electronic components explain this trend. It is bad news for the traditional saver who is seeing their money held in a traditional savings account going up in smoke. Commodities-linked investments are one possible option to counter this trend. This will allow you to start working with a well-diversified portfolio.

Geert Van Herck Chief Strategist KEYPRIVATE