Which sectors should remain overweight following the latest rate hike?

Geert Van Herck

Chief Strategist KEYPRIVATE

October 23, 2023

2 minutes to read

Despite falling inflation figures, FED chairman Jerome Powell seems to be in no hurry to deviate from his monetary policy. Equity investors are still desperately looking to get past the final rate hike. And even though it now seems certain we will see it during this last quarter of the year, the question remains:

what is the best investment strategy for equity investors?

Monetary policy decisions have a major impact on equity markets. A flexible monetary policy will give the global economy breathing space, which will improve economic growth and corporate profits. However, a tight policy with a number of increases in short-term interest rates will not appeal much to investors because it will create a prospect of lower growth and greater pressure on corporate earnings.

This is exactly what we have lived with in recent years: in the US, the UK and the euro zone, central bankers raised short-term interest rates to slow down the economy in order to push inflation back down to lower levels.

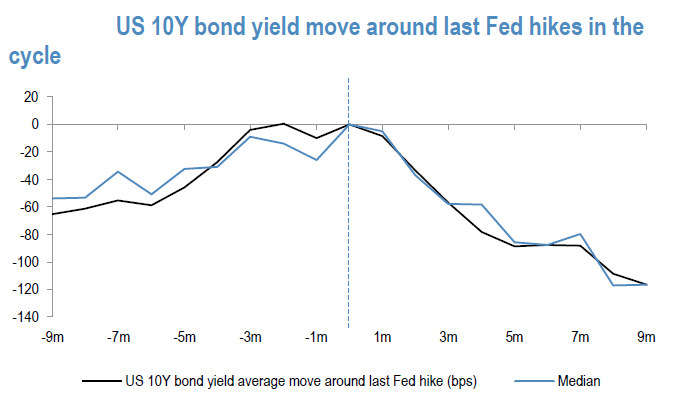

More and more economists and stock market strategists are now assuming we are reaching the end of this “aggressive” period of continual rate hikes. This should ease the nervousness on the stock markets. One recent study by US investment bank JPMorgan shows that this would likely go hand in hand with a drop in long-term interest rates.

Figure 1 shows very clearly that the final US rate hike always leads to a trend reversal on the bond market. This is good news for the stock markets, as lower interest rates will stimulate equity investments.

Figure 1: US long-term interest rates before/after the final rate hike

Source: JPMorgan

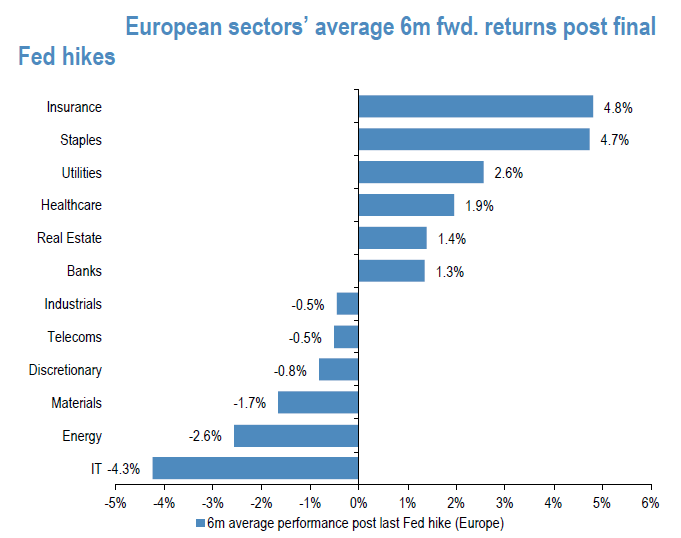

This data provides investors with valuable information: history shows that lower long-term interest rates tend to favour the more defensive sectors. It is easy to understand why: a period of monetary tightening is aimed at cooling the economy. This is not the best environment to invest in highly cyclical companies such as commodities or energy suppliers. After all, demand for oil, copper and iron ore will decline when there is lower economic growth.

On the other hand, defensive sectors can perform well on the stock market. Companies working in the production of food and beverages or pharmaceuticals can achieve stable cash flows even in more challenging economic times. After all, consumers will continue to eat and drink and take their medicine. Figure 2 shows that these sectors (staples and healthcare) performed well in the six-month period following the latest rate hike. Typical dividend shares in the real estate or the utilities sectors (for example companies such as Engie) also do well because the lower long-term interest rate makes new bond coupons less attractive compared to the dividend yield in these two sectors.

Figure 2: Sector performance in the 6 months following the latest interest rate hike

Source: JPMorgan

Our conclusion

The end of the current period of monetary tightening could lead to calm waters for equity investment. During the months following a rate hike, we can see from an analysis of previous periods that defensive equity sectors can perform well, especially compared to their cyclical counterparts. In the current market environment, it is reasonable that you may want to put look your portfolio under the microscope and limit excess exposure to cyclical names in order to invest more in defensive equities.