Investors, never pay too much for your favourite share!

Keytrade Bank

keytradebank.be

October 08, 2021

(updated August 21, 2024)

4 minutes to read

Anyone who invests in shares needs do their homework properly. That is an often-heard cliché that boils down to the fact that you really need to take a long, close look at the balance sheet and profit and loss account of a listed company before making any investment decisions. Nevertheless, investors are often disappointed by the price growth of the shares they select. Is this the result of paying too high a price? What is the impact of a share's valuation on its future price growth?

Over the past few weeks, we have come across an interesting study in which the author presented a good analysis of the emotional aspect of investing.

Today, we often hear it said that you should only really invest in shares. Savings accounts yield nothing any longer. TINA, right? “There Is No Alternative”. Of course, it is absolutely true that on average shares have yielded more than savings accounts. But as an investor, it is still a good idea to remain a bit selective. Don't be tempted by the coolest share of the week, as it could well turn into a major disappointment.

The past can teach us more about a number of hypes that investors were all too happy to join in with, and where many ended up deceived and stranded. Why is this?

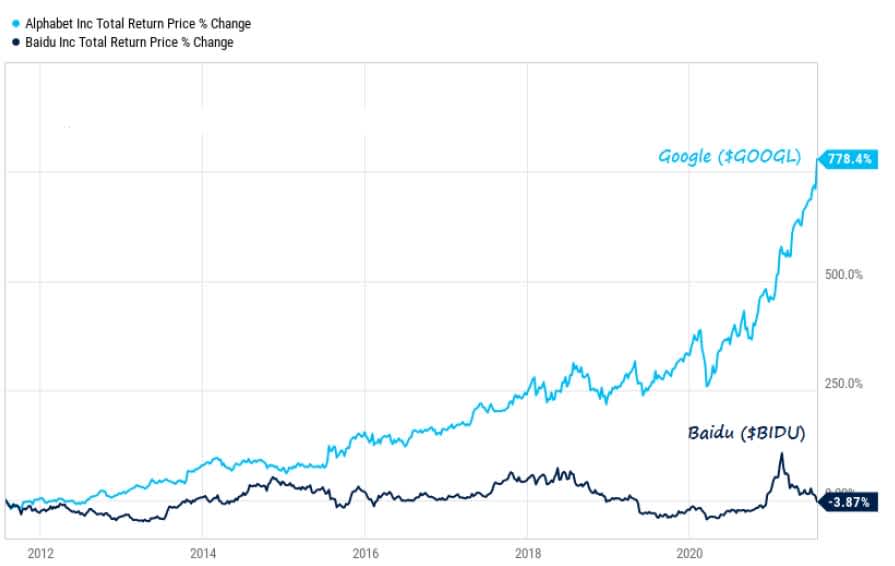

Some ten years ago, investors were completely spellbound by Chinese Internet shares. Google’s Chinese counterpart, Baidu, was the focus of much interest. The result: investor demand was high, causing its valuation to soar. Google, on the other hand, had a lower level of demand and was therefore valued more cheaply.

The valuations at that time:

- Baidu: price/turnover = 42

- Google: price/turnover = 6

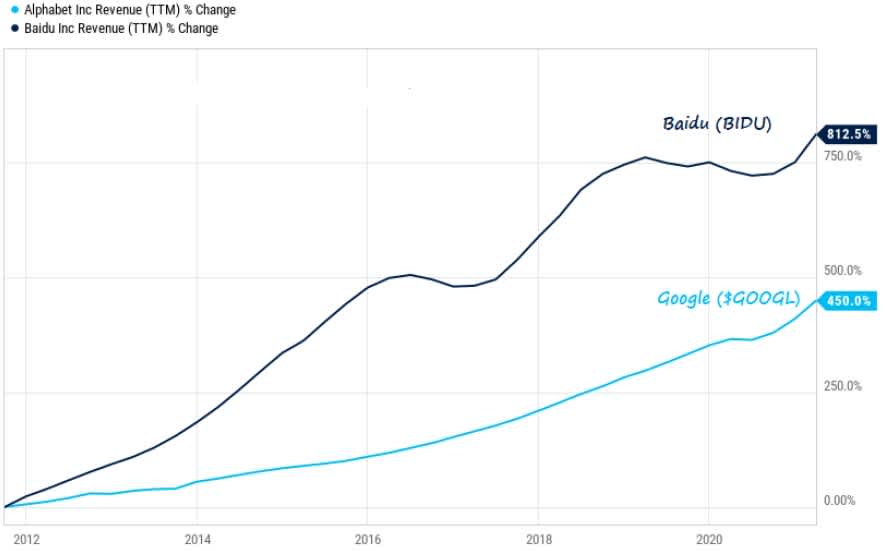

Figure 1: Baidu - Google turnover growth

Source: Compound

The result some 10 years later: Baidu was indeed able to record strong growth. This is illustrated by the increase in turnover in Figure 1. On the other hand, its stock-market performance was a serious disappointment. This is illustrated by Figure 2. The price of Google, which was valued cheaply, exploded, while investors in Baidu even faced a slight loss. The valuation has a staggering impact on the future returns on shares that are bought too high. Could it be any clearer?

Figure 2: Price trends Baidu – Google

Source: Compound

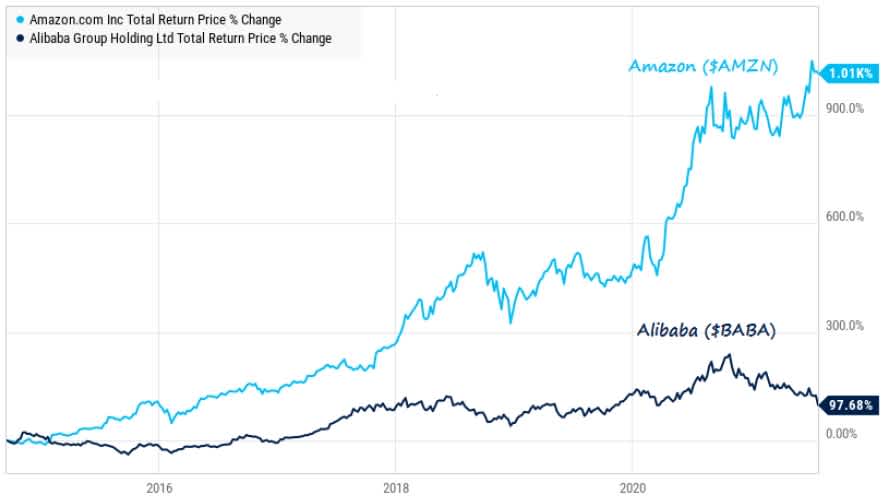

Example 2 dates back to the IPO of the Chinese e-commerce giant Alibaba. In September 2014, founder Jack Ma took the company to the stock market and once again investors were thrilled to bits. The faith in the potential of the Asian online procurement market was enormous. As a result, investors were willing to pay a lot in order to join in this stock market celebration. At that time, Jeff Bezos' Amazon was clearly well out of the limelight, which translated (translates) into a low valuation.

The valuations in 2014:

- Alibaba: price/turnover = 24

- Amazon: price/turnover = 1,8

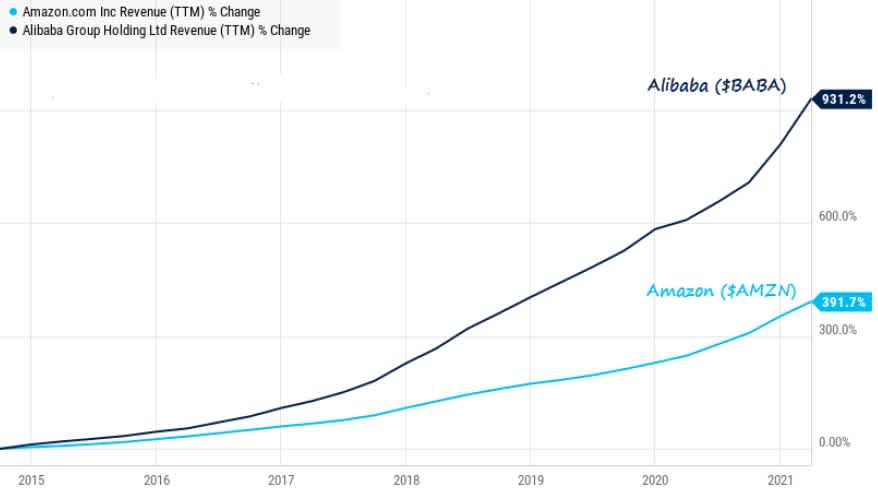

Figure 3: Alibaba – Amazon turnover growth

Source: Compound

You already guessed it, of course. Alibaba easily met the expectations for turnover growth, but this had no impact on the stock market. We can see that a very expensive Alibaba was able to achieve a return (price increase + dividends) of around 100% in the years that followed, but the cheap Amazon did ten times better (+1,000%). Some good advice: as an investor, don't be tempted to pay delirious valuations!

Figure 4: price trends Alibaba – Amazon

Source: Compound

Conclusion

Those who keep their emotions under control when purchasing their favourite share will profit. Resist the temptation to pay extreme valuations! Always look at known valuation ratios such as the price/earnings, price/book value or price/turnover. If these are well above market or sector averages, you should stay away as an investor. Shares you overpaid for will often lead to disappointment. One more conclusion: today, everyone wants to have expensive US technology stocks in their portfolios, while the Chinese names mentioned above have been severely punished. Which shares do you believe will be the glittering stars of the stock market in the next 5 to 10 years?

Geert Van Herck Chief Strategist KEYPRIVATE