Have long-term interest rates once again started a 40-year uptrend?

Geert Van Herck

Chief Strategist KEYPRIVATE

October 30, 2024

2 minutes to read

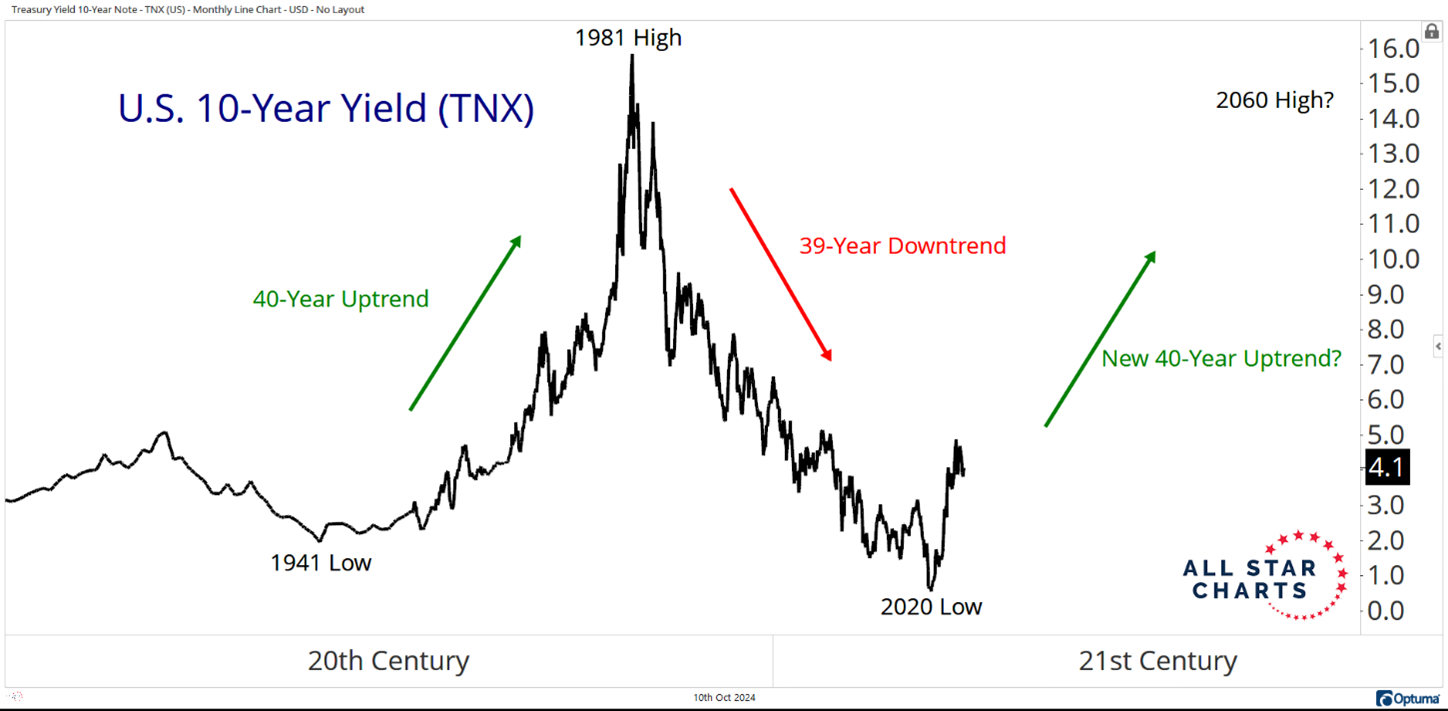

The US 10-year yield goes through long, structural cycles in which rate hikes alternate with rate cuts. When we take a closer look, it very much seems that we have just left behind a long period of interest rate cuts.

Source: All Star Charts

Assuming that this pattern of 40-year cycles is repeating itself, we have just witnessed a significant trend reversal on the international bond markets. And just as Wall Street seems to lead the way for all other regions, the US tends to set the tone for the rest of the world with its 10-year yield.

What profound consequences can this have for the composition of a diversified investment portfolio?

In such a market, bonds with a limited term of 3 to 5 years are the way to go for bond investors. They allow them to reinvest more quickly in new bonds with a higher coupon at maturity. In addition, investors should select high-quality companies. Companies with excessive debt may face repayment problems in the event of structurally higher interest rates.

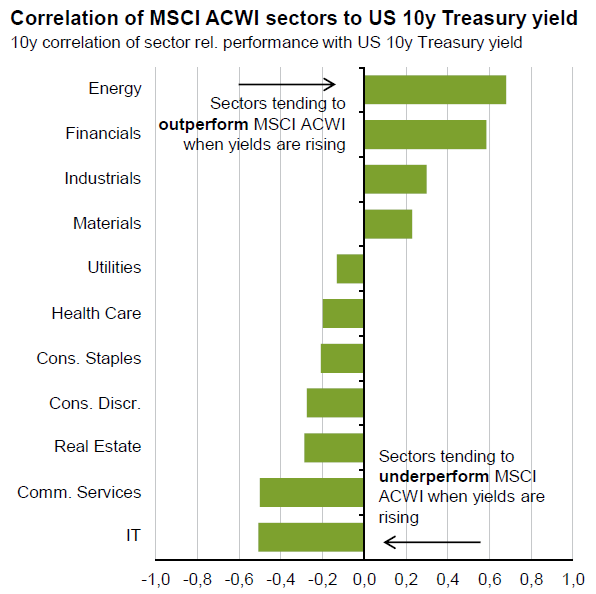

Equity investors are better off focusing on cyclical sectors. The table below shows that oil stocks, banks and insurers and industrial securities outperform the rest in periods of rising long-term interest rates. Sectors that investors are better off ignoring in this situation are real estate stocks and tech stocks. Will Nvidia, Apple, Amazon and the world's other tech giants be able to continue their magnificent achievements? This is certainly something we need to keep an eye on.

Source: J.P. Morgan

And what about commodities? Commodities also offer diversification opportunities in periods of structurally rising long-term interest rates. Higher long-term interest rates tend to go hand in hand with higher inflation figures. And they are inextricably linked to higher prices for oil, copper, cereals and other commodities. If you are looking for a tracker that invests in major commodities, you will find several on our platform.