Investing at new highs is an elevated idea

Geert Van Herck

Chief Strategist KEYPRIVATE

September 17, 2024

2 minutes to read

Ask a group of investors on the stock market whether they would buy when the major stock market indices are trading at record highs ...

... and there's a good chance all the investors in the group would advise you to steer clear. More likely, they would counsel waiting for share prices to drop before investing.

Their reaction is naturally understandable. Record prices often cause fear among investors because they think they are simply 'too late'. Our brains tell us that we may be better off waiting for prices to fall before investing in shares.

But is that really the case?

Research shows that we have to go against what we 'think' and how we 'feel'. Because the fact is that investing at new highs seems to be a very good idea.

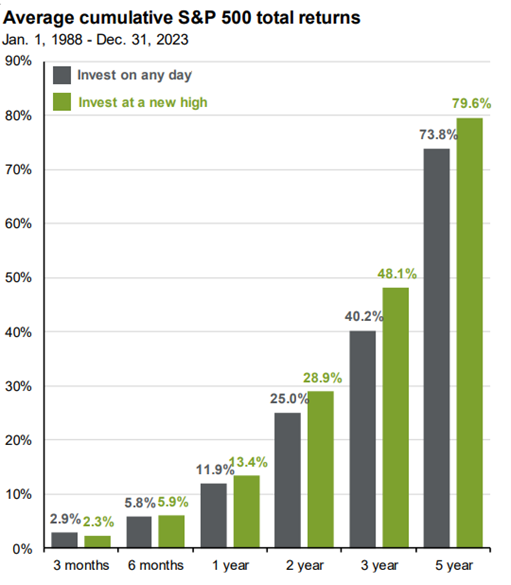

Take a look at the graph above (source of the graph: JP Morgan). It shows that investors who invest at new highs achieve cumulatively higher returns than investors who invest on any day. What's more, the differences in returns increase over time.

So, next time you see stock markets hitting record prices, it may not be a bad idea to go against your emotions and the voice inside your head, and invest!