Cyber security trends: from ransomware attacks to deepfakes

Keytrade Bank

keytradebank.be

November 18, 2024

3 minutes to read

You have probably already noticed it in your mailbox(es). Spam messages are rocketing right now. However, it is not the number of messages that is most concerning. It is their apparent authenticity. It is getting harder and harder to spot the difference between fake and genuine messages. High time for a complete update on the trends in the land of cyber security and how you can be more alert to suspicious online messages.

Why we are particularly vulnerable today

The digital world is getting intertwined with our real lives more than ever before. For most of us, a small or large part of our day is spent online. We read our emails, check our online bank accounts on our smartphones, buy things from online shops …

Almost everywhere we go, we can use public Wi-Fi networks, which may or may not be sufficiently secure. The same applies to your own home network. If you work from home (occasionally), are you sure that all your work data is securely shielded from the outside world?

All this extra freedom comes with greater vulnerability. With the right knowledge and tools, cyber criminals can quickly take a potential shortcut to your bank details and therefore also your bank account. And the risk increases even more if you don't stay up to date on the potential digital threats that are out there.

What are the cyber security trends in the run up to 2025?

The classic spam email has been around for a very long time now. The cyber criminals' arsenal of tricks has become far more impressive and efficient. We present you with a topical selection.

Personalised emails

Even the most distrustful, trained and critical minds are finding it increasingly difficult to distinguish between good intentions and deception. Nowadays, fraudsters tend to take a very personal approach. Even your work mailbox is a potential target.

An effective real-life example: you receive an email from a customer that includes an Excel file based on a quote to be approved. You go over your checklist:

- The name is correct.

- The email address is correct.

- The language is correct.

- Even the customer's email signature is a 100% match.

All good? Wrong! Because when you check with the customer themselves, you find out that this was indeed a phishing message. Someone is trying to steal important data from you by pretending to be someone else.

This example illustrates two very topical cyber security trends. The first is that cyber criminals are immersing themselves in the lives of their potential victims more and more. And the second is that this means they no longer necessarily operate from some faraway country.

Advanced ransomware

A proven recipe that is still very popular. Cyber criminals use ransomware to block access to your data or your company’s data. No one except the criminal can get to the data. They will then tell you that the data will not be released until a ransom is paid.

Companies in particular fall victim to this practice. International industrial player Picanol, the Port of Antwerp, aircraft manufacturer Asco in Zaventem … They were all forced to suspend their operations because of ransomware attacks, resulting in substantial direct and indirect financial losses.

AI brings new challenges

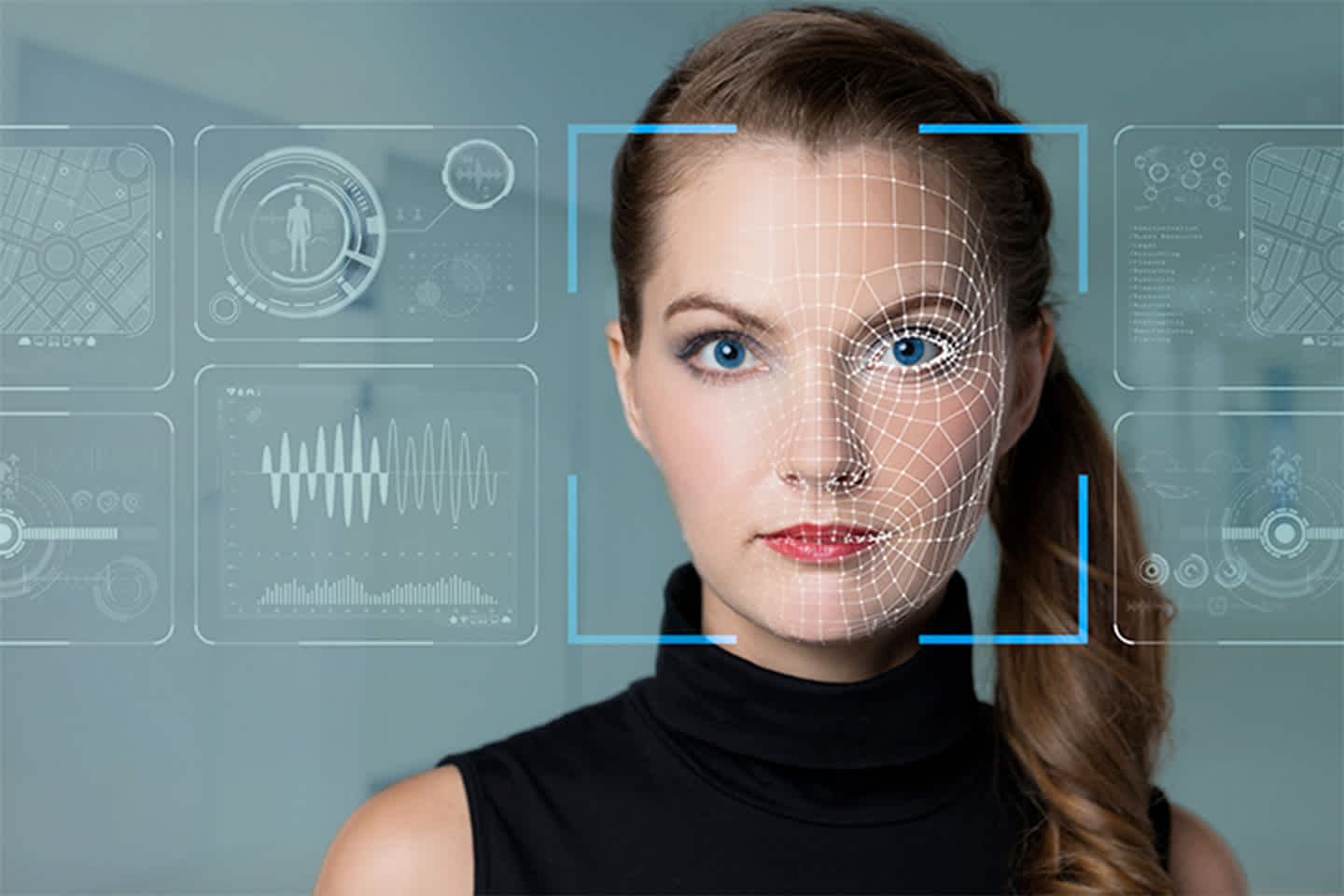

The biggest new threat to general cyber security is artificial intelligence. One of AI's main strengths is detecting patterns – and therefore also weaknesses.

Combine that with self-learning mechanisms and you get phishing emails with fewer and fewer errors or oddities.

Throw in some video and audio technology and suddenly it all becomes very personal. Today, voice cloning can produce a perfect imitation of your trusted bank manager's voice or even the voice of a family member. People who you would definitely trust with your bank details, right?

Deepfake video technology even makes it possible to trick you into thinking you are having a live conversation with a person you trust when actually you are talking to a cyber criminal behind a digital mask. At the beginning of 2024, a company in Hong Kong fell victim to fraud in this way, losing 25.6 million US dollars in the process.

How can you protect yourself against these trends?

Technology doesn't stand still. In the coming years and decades, we will undoubtedly see many new forms of smart cyber crime emerge. As an online banker, we therefore understand the importance of rigorous cyber security. We do everything we can to ensure the best possible technical security for your banking environment, including two-factor authentication.

However, you yourself can stop cyber criminals from getting their way with steps ranging from super-strong passwords to regular software updates. Your own common sense is always invaluable. Has someone asked you to complete a financial transaction out of nowhere? Suspicious!

Keytrade Bank is helping build your digital line of defence

As we said above, you are not alone. At Keytrade Bank, we do everything we can to give you a sense of security during your financial transactions. This starts with following the latest cyber security trends and ends with informing all our customers. We keep you up to date on the latest developments in our blog section.

Like your online transactions, your communication with Keytrade Bank also meets the highest security standards. By using the in-app calling feature of the Keytrade Bank app, you can be 100% sure you will always be speaking to an official Keytrade employee. And the reverse is also true: it means our employees can be sure that it is you on the other side of the line and not someone pretending to be you.

Do you have any questions about your banking experience or do you want to report a cyber fraud case to us?