Will bonds beat shares in 2024?

Geert Van Herck

Chief Strategist KEYPRIVATE

November 21, 2023

(updated December 12, 2023)

4 minutes to read

In “Watch out, danger's about ”, we wrote about Western central banks and the size of their balance sheets. Reducing these balance sheets at the same time as making the expected cuts in official interest rates in 2024 could well lead to higher market volatility.

Intuitively, equity investors will likely see this as a bonus. But is that really the case? Do interest rate cuts help the international stock markets?

In 2022 and 2023, we saw Western central banks following an aggressive policy. They raised short-term interest rates sharply in both the US and Europe. Their goal: to reduce inflation. This monetary tightening policy led to higher volatility in the equity markets, as is evident from looking back at the last few months. From August to the end of October, most stock markets fell by around 10% or more, because it felt as if the US's strict monetary policy would never end. At the beginning of November, however, the US Federal Reserve (FED) announced a break in monetary tightening, causing share prices to suddenly soar.

Financial experts often state that a flexible monetary policy is a plus for the stock markets. They believe it gives consumers and producers breathing room, with consumers taking advantage of lower interest rates to borrow more and producers increasing investment in, say, new machines.

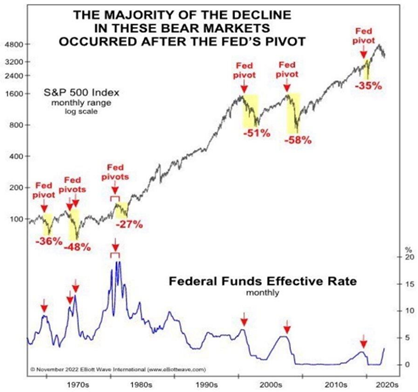

Unfortunately, Figure 1 shows that the reality is quite different. For example, we note that any change in the Fed’s monetary policy direction (a "FED pivot") always coincides with sharp stock market corrections.

Looking back over the last 25 years, all we can say is that every stock market crisis, such as the dotcom crisis, the financial crisis and the Covid crisis, has coincided with a period of rate cuts.

Investors seem to interpret a cut in short-term interest rates more as a sign of economic weakness (fear of recession and lower corporate earnings).

Figure 1: FED interest rate policy v S&P 500

Source: Elliot Wave International

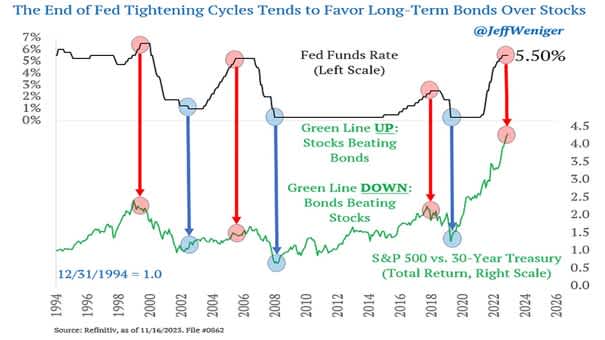

Figure 2 delivers the same message. At the top, we see the trend in short-term US interest rates (Fed Funds Rate) and, below that, the relative performance over 30 years of the S&P 500 compared to long-term US government bonds.

Every time we see a lower Fed Funds Rate, government bonds outperform equities. Take the example of the financial and economic crisis (2007 – 2008): from the moment the US Federal Reserve cut short-term interest rates in September 2007, we see the lower green line starting to fall. This means government bonds will outperform equities. In other words, a more defensive investment will do better than a more dynamic investment.

It is only once short-term interest rates bottom out that shares recover again.

Figure 2: Relative performance of bonds v equities and monetary policy

Source: Jeff Weniger

Conclusion

Contrary to what you read in financial textbooks, a more flexible monetary policy will not usher in a comfortable stock market environment. We think the opposite is actually true. Our analysis clearly shows that periods of monetary easing go hand in hand with higher volatility on the international equity markets.

Now, we certainly don't want to spook investors, but we do want to establish realistic expectations. Many economists and large fund managers are already expecting interest rate cuts in Europe and the US in 2024. In 2024, then, we will need to stay on the alert for a possible trend reversal on the stock markets.

As we all know: when it comes to investment, forewarned is forearmed!